|

新サイト建設中(アメリカ突撃体験レポ本を含めた出版の資金源を模索中)

アメリカでの便利屋(旧サイト)はhttp://benriyausa.comへ

メークオーバーして移転。

|

Chapter Twelve: Young Entrepreneurs and Silicon

Valley

世界を動かすシリコンバレー/Silicon Valley Changes World

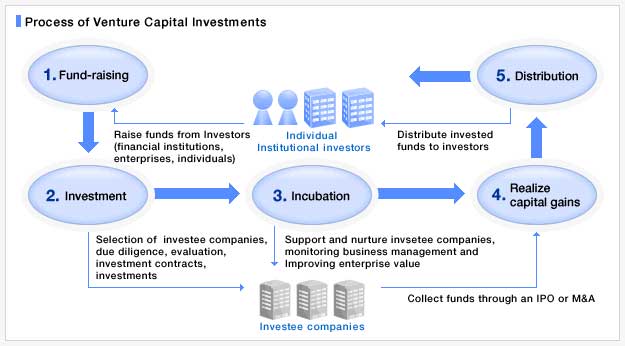

Venture

Capital Venture

Capital

Land of Opportunity.

|

|

36 photos

showing how Silicon Valley went from prune orchards to the center of the

tech world

Matt Weinberger Nov. 10, 2015,

8:46 AM Business Insider

Everyone knows that Silicon Valley is the center of the tech universe.

Apple, Facebook, Yahoo, eBay, and probably half the apps on the App

Store all call Silicon Valley home.

So how did a collection of sleepy suburbs on a peninsula to the

southeast of San Francisco become such an attractor to the tech elite?

It's a tale that goes back to before World War II, to an era when the

Santa Clara Valley was better known for its prunes than its venture

capitalists and on-demand startups.

Here's how Silicon Valley went from prune orchards to aerospace

research labs to the capital of the connected world.

Originally, the Santa Clara Valley was known by a different name — the

"Valley of Heart's Delight." It was famous for its orchards and flowers,

with prunes as the major export.

The namesake of Silicon Valley is the Santa Clara Valley, which runs

from the southeast of the San Francisco Bay down to San Jose, more or

less. San Francisco itself isn't really a part of Silicon Valley.

But since the

mid-1800's, the seeds had been planted for the valley's later rebirth as a

hub of technology. As a hub for both military and commercial ships, the

San Francisco Bay Area was a hotbed for the early telegraph and radio

industries. In 1909, Charles "Doc" Herrold started the country's first

radio station out of San Jose. But since the

mid-1800's, the seeds had been planted for the valley's later rebirth as a

hub of technology. As a hub for both military and commercial ships, the

San Francisco Bay Area was a hotbed for the early telegraph and radio

industries. In 1909, Charles "Doc" Herrold started the country's first

radio station out of San Jose.

Also in 1909, Cyril Ewell led a Palo Alto-based team that developed the

first American-built arc transmitter.

Speaking of military ships, the United States Navy played an important

role in the early days of Silicon Valley. In 1933, the Navy purchased

Moffett Field, a stretch of land in Sunnyvale, California, as a facility

to dock and maintain the USS Macon, a military airship seen here flying

over New York.

Moffett Field became a major hub for the young aerospace industry.

Companies like Lockheed set up shop there to better serve the Navy.

Scientists and researchers found solid, steady work in the area.

In 1939, the Ames Research Center was founded as a lab for the National

Advisory Committee for Aeronautics. In 1949, Ames became home to the

world's largest wind tunnel, critical for aerospace research. These days,

it's also responsible for a lot of NASA's computer science work.

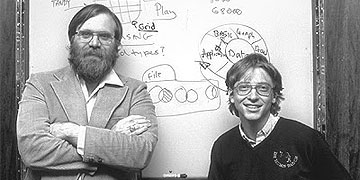

Hewlett Packard is often credited as the spiritual founder of Silicon

Valley. But Stanford grads William Hewlett and Dave Packard didn't make

computing equipment until much later. When they started the company in

their famous garage, the duo was making oscilloscopes and, during World

War 2, radar and artillery technology.

At this point, when people said "computer," they were referring to

machines like the famous Eniac, the room-sized beast of a computer that

helped the United States break enemy codes during World War II.

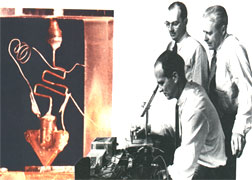

Silicon Valley's tech industry, as we know it today, would get its

start with a man named William Shockley. A brilliant scientist, Shockley

(middle) co-invented the transistor — one of the most basic components of

what we now know as the computer processor — at Bell Labs.

After a series of clashes with management about not getting what he

thought was proper credit for the invention of the transistor, Shockley

founded Shockley Semiconductor Labs, the first-ever company to make

transistors out of silicon rather than germanium. Shockley opted to start

the new company in Mountain View, California, so as to be closer to his

sick mother.

Unfortunately, Shockley's first building became a produce market and

then got torn down, meaning this important bit of computer history has

been lost except for this sign.

Shockley tried to get some of his former Bell Labs colleagues to join

him in California, but nobody would make the cross-country move. Luckily,

local colleges like Stanford University were turning out young graduates

with top-tier educations. It helped that Stanford, in particular,

encouraged students (like Hewlett and Packard earlier) to stay local and

help develop the still-relatively-young California under a concept often

called "regional solidarity."

And so, Shockley staffed his company with young, hungry scientists. But

Shockley was a lousy manager, constantly changing focus on products and

eventually cutting off development of silicon transistors. After being

unable to take it anymore, eight of those young scientists quit the

company. A furious Shockley dubbed them the "Traitorous Eight" and

publicly declared that they would never be successful.

The "Traitorous Eight" teamed up with businessman Sherman Fairchild to

create Fairchild Semiconductor, which picked up with silicon transistors

where Shockley left off. It was originally founded in this tiny office in

Palo Alto. Fairchild gets a lot of credit for helping make computers

smaller, faster, and cheaper with its transistor and circuit research and

inventions.

When the USSR put Sputnik I into orbit in 1957, it was Fairchild that

the newly-formed NASA tapped to make the computer components for the first

manned mission to the moon. It was a successful project that seriously put

Fairchild and the region on the map.

All of the "Traitorous Eight" would go on to cofound or finance some of

Silicon Valley's biggest companies. In 1968, Gordon Moore and Robert Noyce

would cofound a microprocessor company called Intel, headquartered in

Santa Clara. Other so-called "Fairchildren" companies include AMD and

NVIDIA.

The public sector was also rapidly contributing to the growing computer

scene in Silicon Valley. In 1969, the Stanford Research Institute became

home to one of the first four nodes of ARPANET, the first attempt by the

United States Department of Defense Advanced Research Project Agency (ARPA)

to create a global computer network. It was the first version of today's

world wide web.

In 1970, Xerox opened the Xerox PARC lab in Palo Alto. It was PARC that

invented many aspects of modern computing, including ethernet networking,

the concept of the graphical user interface, laser printers, or computer

graphics. PARC would go on to develop the Xerox Alto, a precursor to the

modern PC.

Thanks to all these advances, the Valley of Heart's Delight had become

a boomtown for the young computer industry. The name really caught on when

journalist Don Hoefler titled a three-part report on the semiconductor

industry "SILICON VALLEY USA." Even after silicon-based components stopped

being the chief export of the area, the name stuck.

In 1972, two financial types with tech industry experience named Eugene

Kleiner and Tom Perkins (pictured) raised their first venture capital fund

for young companies in the newly-dubbed Silicon Valley trying to get into

the space.

Things started moving fast. In 1971, Intel released the Intel 4004

processor, the first that was cheap and reliable enough for home use. When

it was followed up in 1973 with the even more useful Intel 8080, a

hobbyist scene of amateur computer enthusiasts popped up.

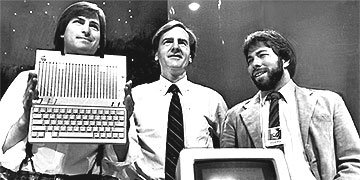

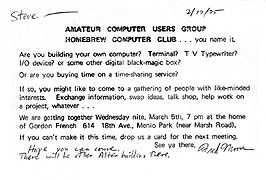

Silicon Valley's local fan group, the Homebrew Computer Club, would

turn out to be pivotal to the future of tech when two young enthusiasts

named Steve Wozniak and Steve Jobs showed up to its first meeting in 1975.

At the first meeting of the Homebrew Computer Club, Jobs and Wozniak

got to try out the Altair 8800, an early microcomputer based on one of

those Intel chips.

That meeting inspired the duo to create the Apple I, a do-it-yourself

computer kit where they'd just sell you the Wozniak-designed motherboard

that they built in a garage. Their follow-up, the Apple II, was one of the

first-ever real personal computers, and turned Apple Computer into a real

company.

This period also saw the birth of other tech titans, as the demand for

software for these new computers grew. Database company Oracle was

co-founded by Larry Ellison, Bob Miner, and Ed Oates in 1977.

When Apple Computer had its IPO in December of 1980, it jump-started

the Silicon Valley scene. Venture capitalists came in droves to try to get

in on the boom.

Sand Hill Road, the street in Menlo Park, California where Kleiner

Perkins set up, became the hub of the venture capital world, a status it

still enjoys today.

In the eighties, as computers started to slowly but surely work their

way into the mainstream, Silicon Valley just kept growing. In 1984,

ex-Stanford faculty Leonard Bosack and wife Sandy Lerner would found Cisco

Systems, building and selling exact clones of Stanford's networking

software.

By the mid-eighties, Silicon Valley was established as the center of

the computer industry, which was only on the rise. Sun Microsystems, which

made computers and early operating system software was founded by a bunch

of Stanford alumni in 1982.

The eighties would give way to the nineties, bringing a new kind of

company to Silicon Valley: Thanks to the PC starting to hit the

mainstream, and the rise of the internet, 1995-2000 would see companies

like Google, Yahoo, eBay, and lots of others hit the scene during the

height of the dot-com bubble. Just like HP and Apple before it, Google was

founded in a Silicon Valley garage.

Meanwhile, even the old guard of Silicon Valley kept growing, with

companies like Intel, Sun, and Silicon Graphics Inc. (SGI) taking over

huge campuses all over Silicon Valley. Sun's campus, which it moved into

circa 1998, was actually a historic ex-psychiatric hospital.

During the Dot Com Bubble, companies like Sun thought the good times

would never end, and so spent a lot of cash that it didn't have to grow

beyond a sustainable level. When the bubble finally finished bursting in

2001, it sapped all of Sun's momentum, leaving it vulnerable to a $5.6

billion takeover from Oracle in 2009. In 2011, Oracle sold the Sun campus

to Facebook.

Mark Zuckerberg purposely left the Sun sign on the back of the Facebook

sign as a warning to employees that they can never stop improving, or else

meet a similar fate.

Similarly, Google started to rent the Googleplex campus from Silicon

Graphics Inc. in 2003, before buying it outright from them in 2006.

Still, even as things change, Silicon Valley remains the center of the

tech universe, with Apple, Google, Facebook, Yahoo, and many more calling

it home for the foreseeable future. Apple is even building its new,

massive "spaceship" campus in Cupertino, California, right near the old

one.

And you know that Silicon Valley has made it into the big time when HBO

has a hit series of the same name. And the rest, as they say, is history. |

|

R.I.P. HP

What Silicon Valley can learn

from the rise and fall of its original tech startup.

By Will Oremus

http://www.slate.com/articles/technology/technology/2014/10/hewlett_packard_hp_split_the_rise_and_fall_of_silicon_valley_s_original.html

Photo=Hewlett-Packard co-founder Bill Hewlett on June 6, 1977

It started with two engineers tinkering in a Silicon Valley garage.

Behind brilliant ideas and a distinctive corporate culture, it grew into

one of the most successful technology companies of all time.

That’s true of both Apple and Google. It’s also true of

Hewlett-Packard—a company that predated them by some 40 and 60 years,

respectively.*

HP today is a broken shell of its former self. The seeds of its

downfall were sown decades ago, when its focus shifted from high-end

innovation to mass production of low-cost devices. On Monday, CEO Meg

Whitman announced that it’s splitting into two companies: HP Inc. will

hawk computers and printers while Hewlett-Packard Enterprise will focus on

high-end business hardware and software, like IBM. It’s the second time in

15 years the company has spun off a core business—it turned its test and

measurement division into Agilent in 1999, and it has been reeling ever

since.

In its time, however, Hewlett-Packard was like nothing the business

world had seen. It was, in many respects, the prototype from which the

idea of the Silicon Valley startup sprang. Its former glory and longevity

are worth recalling in an age when the potential for tech companies to

strike it rich is taken for granted—and so is their evanescence.

The outlines of HP’s history have been well-traced, including by

Michael S. Malone in Bill & Dave: How Hewlett and Packard Built the

World’s Greatest Company, and by co-founder David Packard himself in The

HP Way: How Bill Hewlett and I Built Our Business. The two met as

undergrads at Stanford University under the tutelage of the legendary

electrical engineering professor Frederick Terman; in 1939, at Terman’s

urging, they formed their own company in a one-car garage on Addison

Avenue in Palo Alto, California, then a sleepy suburb known more for fruit

orchards than industry.

Photo=he newly renovated HP garage on Addison Avenue is seen Dec. 8,

2005, in Palo Alto, California

Like a lot of tech startups today, Hewlett and Packard decided to start

a company before they knew what it was they wanted to build. They

considered everything from medical equipment to air-conditioning control

systems before settling on an audio oscillator that they managed to sell

to Walt Disney, who used the devices in producing the soundtrack for

Fantasia.

The founders were driven not by a particular business model or

million-dollar idea, but by the conviction that, in Packard’s words, “we

were able to design and make instruments which were not yet available.”

The company’s subsequent products established it as a leader in

instruments for measuring and testing electronic signals and devices.

By World War II, the company was scaling up rapidly to win and fulfill

government contracts for its oscillators and vacuum-tube voltmeters. Out

of necessity was born a corporate culture that would come to define

Silicon Valley startups in the ensuing decades. As Walter Isaacson

recounts in his new book The Innovators, citing Malone:

While Bill Hewlett was in the military, Dave Packard slept on a cot at

the office many nights and managed three shifts of workers, many of them

women. He realized, partly out of necessity, that it helped to give his

workers flexible hours and plenty of leeway in determining how to

accomplish their objectives. The management hierarchy was flattened.

During the 1950s this approach merged with the casual lifestyle of

California to create a culture that included Friday beer bashes, flexible

hours, and stock options.

Over the years this approach coalesced in a management philosophy known

as “the HP Way.” It emphasized problem-solving over profit-chasing and

trust in employees over top-down management. It became a blueprint for the

semiconductor industry, and then Intel, and ultimately the technology

industry as a whole. The company made money—piles and piles of it—but it

did it by continually inventing and honing useful products, not by

maximizing volume and slashing costs.

“HP’s cultural legacy runs very, very deep,” Leslie Berlin, historian

for the Silicon Valley Archives at Stanford, told me in a phone interview

Monday. “The notion that literally a couple of tech guys in a garage could

not only make it, but hit the ball out of the park—and that they did it

without alienating their labor—it really helped to kick-start the Valley.”

Berlin hears echoes of “the HP Way” in Google’s corporate motto, “Don’t be

evil,” as well as in the company’s seemingly utopian corporate culture.

Malone, author of books about both Hewlett-Packard and Intel, agreed in

a phone interview that HP was in many ways “the founding company of

Silicon Valley.” But in other respects, he told me, it has always stood

apart, whether due to the nature of its business or the magnitude of its

success. While semiconductor and microchip companies—and, later, Internet

startups—duked it out in cutthroat competition on the Valley floor, HP

shone as a gold-paved citadel in the foothills where happy, healthy,

lifelong employees settled in and raised families.

Hewlett and Packard may have treated their workers humanely, but they

were unsentimental when it came to the company’s products and business

models. “As early as the mid-1950s, an internal HP study showed that sales

of most of the company’s products declined in the fourth or fifth year as

their technological advantage slipped,” reported David Jacobson in a 1998

Stanford Magazine cover story. “So, in order to grow, the company had to

generate an increasing amount of its revenues from newer ideas.” In a 2000

Forbes article, Malone elaborated:

"The key to the greatness of Bill Hewlett and David Packard was that

they held no attachment to things, only people. The garage was left

behind, as would be, in time, the redwood building. So too was the audio

oscillator and thousands of other products—all abandoned in the endless

pursuit of something better. Only the people remained, and they were

cherished and respected. "

It’s hard to say just when the company began to lose the edge that its

founders and their successors had been so careful to keep sharp. Some

analysts pin the turning point on the tumultuous tenure of former CEO

Carly Fiorina, who came to the company with a background in sales rather

than engineering and orchestrated its acquisition of Compaq in 2002.

Critics say she doubled down on the company’s maturing PC-sales business

at the expense of more forward-looking products. Others fault her

hard-charging successor, Mark Hurd, who pushed the company to tremendous

profits through aggressive management and ruthless cost-cutting. The

strategic flailing and soap-opera board intrigue that characterized Léo

Apotheker’s 11-month reign certainly didn’t help.

Most agree, however, that the company had grown sclerotic and unwieldy

even before Fiorina arrived. In a 2005 foreword to Packard’s book, Jim

Collins wrote that HP in the 1990s “confused operating practices with core

values” and “veered off course” with acquisitions whose success depended

on cost-cutting and market share rather than technical innovation.

While the latest split-up may sound like a death knell, Malone believes

it gives Whitman a chance to reshape Hewlett-Packard Enterprise in the

mold of IBM, which sold its PC business to Lenovo in 2005. But even if

that’s the case, it’s clear by now that the HP of old is not coming back.

For a time, though, all of the virtues of Silicon Valley at its best

came together in a company that was at once wildly profitable and

universally beloved. “Between 1955 and about 1965, HP was probably the

greatest company ever,” Malone said. “It produced the kind of innovation

you saw from Apple in the 2000s, but it was simultaneously the most

enlightened employer in the country. They had the highest employee morale

levels ever measured.”

In 1955, Hewlett-Packard was 16 years old. It has been 17 years since

Steve Jobs retook the reins at Apple and remade the company in his image.

And Google turned 16 years old this year.

*Correction, Oct. 8, 2014: This article originally implied that

Hewlett-Packard predated Google by about 40 years and Apple by about 60.

In fact, it predated Apple by about 40 years and Google by about 60. |

|

The Sad Saga of Silicon

Graphics: The Final Chapter

Peter Burrows on April 01, 2009

http://www.businessweek.com/the_thread/techbeat/archives/2009/04/the_sad_saga_of.html

There was a time when Silicon Graphics Corp. was the Apple Inc. of

corporate computing. It received coverage out of all proportion to its

size, certainly by BW. And for good reason: It involved larger-than-life

characters such as Jim Clark, who went on to co-found Netscape. SGI was

forever on the cutting edge of technology innovation, and pioneered use of

powerful computing technology in the making of movies, game consoles and

for early Web companies in the mid-1990s. And it was a lightning rod in

the best sense, always a central player in the big debates roiling the

computer industry (workstation vs minicomputer, Risc vs Cisc and UNIX vs

Windows, come to mind).

Today, the company was sold for a piddly $25 million to server-maker

Rackable Systems. Given evaporating sales of its proprietary machines in

recent years, it was weighed down with more than $500 million in debt.

This despite the fact that just two years ago it emerged from a

pre-packaged bankruptcy similar to the ones being considered for GM and

Chrysler right now. (Managed bankruptcy is designed to help companies

quickly put their finances in order so they can continue to operate in

shareholders’ best interests.)

If there’s a farther fall in tech history, I can’t think of it. Despite

breathless headlines, the fact is that few really successful tech

companies come to this. IBM survived its dark days in the early 1990s, to

emerge as a services powerhouse. Apple had just a few weeks of cash left

when Steve Jobs returned in 1997, but he did return. Other once-proud

players — Lotus, DEC, Netscape — at least sold for a number that started

with a “b” rather than just millions. Even Sun (which put out acquisition

feelers for SGI many times in the past) looks likely to get close to a

100% premium if it is acquired by IBM as expected.

I haven’t bothered to spend much time with SGI in recent years. That’s

something I’ve felt somewhat guilty about. Silicon Valley is supposed to

champion real innovators, and SGI never stopped innovating. (Full

disclosure: part of the reason I stopped visiting is that on a few

occasions I almost lost my lunch watching demos of flight simulations and

such on the huge, immersive, theater-like visualization centers that were

themselves a breakthrough in “visual computing.”)

In the end, SGI’s mistakes of the 1990s were too much to overcome.

There was the basic mismanagement, which my bureau chief Rob Hof

chronicled so well in this 1997 cover story (it’s worth reading again;

probably the only time a BW story has mentioned a CEO “moon[ing] SGI

employees at one of the company’s annual lip-synch contests.”). And there

was a chronic indecisiveness about what to do when the server market

really began to commoditize around Wintel. Former HP executive Rick

Belluzzo, a Wintel fan, tried his best for a couple of frustrating years.

After he left, the company turned back to its proprietary ways—continuing

to fight technology wars, but without the scale of a Sun to be able to

support a viable business.

But this end is even more evidence that SGI is a company snakebit by

bad timing. After all, SGI ran out of future just as the enterprise

computing business is getting focused on breakthrough innovation again.

For years, it was all about which Wintel provider could deliver the

cheapest blade. Now, there’s a battle royal going on to rethink the data

center, in ways that will surely require major changes to the underlying

gear. Rather than the same old servers, routers and storage systems, all

of these elements are being glommed together in new ways; that’s certainly

the point of Cisco’s “Project California” initiative, which has shaken up

the sector more than anything in years. As one of my editors put it today,

“servers are sexy again.”

It was only a matter of time for the pendulum to swing back that way.

While commodity hardware isn’t going away, all of the focus on low

purchase price hasn’t solved problems with power consumption or with

controlling operating costs related to running thousands of cookie-cutter

devices. Nor will today’s computers help big Net companies keep up with

sky-rocketing Net traffic, without further advances. It’s too bad that SGI

won’t be there to be part of it. |

グーグルもアップルも サンフランシスコの磁力

[日経産業新聞2015年8月11日付]ブランドン・ヒル(米ビートラックスCEO)

米国のシリコンバレーは世界のIT(情報技術)産業の中心地として知られている。しかし、ここ数年で世界的に話題になっているスタートアップ企業の多くがシリコンバレーではなく、その北にあるサンフランシスコに存在していることは、日本ではまだあまり知られていない。日本からシリコンバレーに来たはずだったのが、実際には打ち合わせの場所がサンフランシスコだったり、視察対象がサンフランシスコにある会社だったりすることも珍しくない。

札幌市生まれ。サンフランシスコ州立大学デザイン学科在学中からウェブサイトのデザイナーとして活躍。卒業後の2004年にブランディング・ユーザーエクスペリエンスデザインを手掛けるビートラックスを設立。趣味はバイク、テニス、ロック音楽。

札幌市生まれ。サンフランシスコ州立大学デザイン学科在学中からウェブサイトのデザイナーとして活躍。卒業後の2004年にブランディング・ユーザーエクスペリエンスデザインを手掛けるビートラックスを設立。趣味はバイク、テニス、ロック音楽。

サンフランシスコはシリコンバレーの一部、もしくは隣同士と思っている方は多い。厳密に言うと、接してはおらず、自動車で移動する場合でも片道30分から1時間かかる。サンフランシスコが都市の名前であるのに対し、シリコンバレーは複数の都市が集まった地域の総称である。現地の人たちは、サンフランシスコとシリコンバレー地域をあわせて「SFベイエリア」と呼んでいる。

ここ数年、IT系企業の多くがサンフランシスコにオフィスを構えている。ツイッターやドロップボックスもサンフランシスコ発祥の企業である。非上場で評価額が100億ドルを超える「ユニコーン」と呼ばれる企業の多くがサンフランシスコにオフィスを持っている。日本でも話題になっているウーバーやエアビーアンドビー、ピンタレスト、ツイッター創設者が始めたモバイル決済のスクエアなどが該当する。

スタートアップ企業に投資するベンチャーキャピタル(VC)と呼ばれる投資機関や、小規模のチームが共同で作業をするためのオフィスを提供するコワーキングスペース、少額出資やアドバイスを提供することで企業を育てるアクセラレーターなど、サンフランシスコはIT系企業を育む環境が整っている。

最近では、もともとシリコンバレーに本社を構えていた企業がこぞってサンフランシスコにオフィスを開いている。最大の目的は若くて優秀な人材の獲得である。エンジニアをはじめとするIT系の人材獲得競争が激しくなっているため、より多くの人材を集めやすい地域にオフィスを開設するのだ。

グーグルはサンフランシスコにオフィスを構えている。セールスフォースとリンクトインは現在、自社ビルをサンフランシスコに建設中だ。そしてつい先日にはアップルもサンフランシスコにオフィスを開設することを発表した。

これらの企業をはじめ、多くのIT系企業は市内の「SOMA」と呼ばれる地域に集中しており、米国では珍しく徒歩で多くの企業を訪問できる。当社もSOMAにある。

当社が入居しているビルの1階はコワーキングスペースであり、その向かい側にはスマートロック(スマートフォンで開け閉めができるカギ)を提供する企業のオフィスがある。その上の階にはコンテンツ配信システムを提供する企業が入居している。

SOMAの面積は東京の山手線の内側程度でしかなく、人口も100万人に満たない。その小さな街にそれだけ多くのIT系企業がひしめき合っていることからも分かる通り、街全体がIT系で働く人々であふれかえっている。

まだまだ日本では、シリコンバレーのブランド力が強いが、現地ではサンフランシスコの勢いがどんどん増している。今後もそのスピードは加速する一方だろう。

ブランドン・ヒル(米ビートラックスCEO)

札幌市生まれ。サンフランシスコ州立大学デザイン学科在学中からウェブサイトのデザイナーとして活躍。卒業後の2004年にブランディング・ユーザーエクスペリエンスデザインを手掛けるビートラックスを設立。趣味はバイク、テニス、ロック音楽。

*****

シリコンバレーで日本人が起業する意味

フィル・キーズ(米ブルーフィールドストラテジーズ アナリスト)

[日経産業新聞2015年8月4日付]

今年春、安倍晋三首相がシリコンバレーを訪れ、日本の有望な企業や人材をシリコンバレーに送り込む方針を打ち出した。「シリコンバレーと日本の架け橋プロジェクト」だ。5年間で200社の中小・ベンチャー企業を選び、シリコンバレーに進出させる。若手の起業家やベンチャーキャピタリストを合わせて30人選び、シリコンバレーに派遣する。

このプロジェクトは現地でも大きな話題となった。このプロジェクトの意義について、シリコンバレーで活動しているベテラン起業家の高坂悟郎氏に聞いた。

高坂氏は現在、メガネに取り付ける小型ディスプレーを開発しているベンチャー企業「Vufine」の会長兼最高経営責任者(CEO)を務めている。高坂氏は日本企業の米国支店を設立するため、2001年にシリコンバレーに来た。その後、日米及び台湾の企業へのコンサルティングをして、現地での日本人起業家の団体「Silicon

Valley Japanese Entrepreneurs Network」の役員になった。

高坂氏は今の会社を15年2月に立ち上げた。その前はあるベンチャー企業の幹部だった。その会社は米グーグルのメガネ型ディスプレー製品「グーグルグラス」と競合する製品を出していた。「07年に米国永住権を得たときから起業家になる希望があった」と高坂氏は語る。

起業家にとってシリコンバレーは様々な利点がある。高坂氏は中でもオープンな環境を強調する。「事業を進めるときに味方になってくれそうな人と知り合える機会がたくさんある。1年中、トレードショーにいるような感覚だ」

米国で企業を設立することの利点も大きい。「米国なら、大手企業でもベンチャー企業と一緒に仕事をするリスクを取る動向がある」(高坂氏)。日本の大手企業はベンチャー企業が持ち込んできた製品に対して、仕様書通りに本当に動くのかをチェックしたり、細かい点にすぐ文句を言ったりすることが多い。高坂氏は「米国では、優れている製品・サービスを手掛けていることを示せば、細かいことを言わない」と述べる。

ベンチャー企業を設立して出資者から資金を預かる責任を持つことについて高坂氏は「思ったより楽しい」と話す。ある決断をした後、その結果がどうなるのかを自分でたどれるのが面白いそうだ。今までに学んだことを経営に生かせるという体験は魅力的なのだろう。

安倍首相がシリコンバレーを訪問した時、高坂氏は安倍首相と会った。高坂氏は「シリコンバレーと日本の架け橋プロジェクト」について、シリコンバレーに来た人が日本に戻り、経験や知識を広めることを狙っていると思っていた。シリコンバレーに来た日本人の多くはシリコンバレーを気に入り、日本に戻らない。だから安倍首相のもくろみは外れると考えた。

だが、安倍首相はシリコンバレーに日本人が残っても構わないと考えており、日本とシリコンバレーの関係がさらに深まることを意図している。「日本にはシリコンバレーに関する知識や情報が足りない。優秀な人材や企業が来ることでギャップを埋められる」(高坂氏)

シリコンバレーで起業しようとする日本人に高坂氏はアドバイスする。「勉強不足とかまだできないとか言ってはならない。まず一歩踏み出し、試行錯誤している間に準備が整う」

フィル・キーズ(米ブルーフィールドストラテジーズ アナリスト)

カリフォルニア大学バークレー校在学中に交換留学で来日。日本のIT(情報技術)産業にも詳しく、技術誌やウェブサイトなどでジャーナリストとして活動。日本での勤務経験もある。

**** |

Overvalued in Silicon Valley, but Don’t Say ‘Tech Bubble’

By CONOR DOUGHERTYMAY 22, 2015

Today, people see shades of 2000 in the eye-popping valuations of

companies like Slack, whose offices are seen at top; Uber; and Airbnb, at

bottom. Credit From top: Jason Henry for The New York Times; Sam Hodgson

for The New York Times; and Matthew Millman for The New York Times

SAN FRANCISCO — It is a wild time in Silicon Valley. Two-year-old

companies are valued in the billions, ramshackle homes are worth millions

and hubris has reached the point where otherwise sane businesspeople muse

about seceding from the United States.

But the tech industry’s venture capitalists — the financiers who bet on

companies when they are little more than an idea — are going out of their

way to avoid the one word that could describe what is happening around

them.

Bubble.

“I guess it is a scary word because in some sense no one wants it to

stop,” said Tomasz Tunguz, a partner at Redpoint Ventures. “And so if you

utter it, do you pop it?”

Continue reading the main story

Related Coverage

A bubble, in the economic sense, is basically a period of excessive

speculation in something, whether it is tulips, tech companies or houses.

And it is a loaded, even fearful, term in the tech industry, because it

reminds people of the 1990s dot-com bubble, when companies with little

revenue and zero profits sold billions in stock to a naïve public.

In 2000, tech stocks crashed, venture capital dried up and many young

companies were vaporized. Even today, with the technology industry on

fire, venture capital investment remains below its 2000 peak.

“Anybody who lived through that will always wake up and see ghosts,” said

Jerry Neumann, founder of Neu Venture Capital in New York.

Today, people see shades of 2000 in the enormous valuations assigned to

private companies like Uber, the on-demand cab company, which is raising

$1.5 billion at terms that deem the company worth $50 billion, and Slack,

the corporate messaging service that is about a year old and valued at

$2.8 billion in its latest funding round.

A few years ago private companies worth more than $1 billion were rare

enough that venture capitalists called them “unicorns.” Today, there are

107, according to CB Insights, enough that venture capitalists had to

create a second term — “decacorn” — for private companies like Uber and

the data analysis company Palantir Technologies that are worth more than

$10 billion.

Nobody doubts that many of tech’s unicorns are indeed real businesses and

that some could be with us for decades. But because of low interest rates,

tech companies are raising gobs of money from investors whose desperate

need for returns has pushed them into riskier territory. Start-ups have

begun attracting money from hedge and mutual funds that don’t usually

invest in tech companies before they are public.

Valuations — and there is no real standard for determining how much a

private company is worth — are inflating, leading some people to worry

that investment decisions are being guided by something venture

capitalists call FOMO — the fear of missing out.

In a recent analysis, Mr. Tunguz of Redpoint, who was in high school when

the dot-com bubble burst, found that investors were paying twice as much

for stakes in private technology companies as they were for those that

were publicly traded.

He called it “a runaway train of late-stage fund-raising.” He also called

it “a really weird time” and “a really hard environment to maintain

financial discipline.”

Continue reading the main story

The problem with the bubble question is nobody seems to agree on what

exactly a bubble is. Robert Shiller, an economist whose work on stock

prices earned him the 2013 Nobel Prize and who wrote the bubble book

“Irrational Exuberance,” defined speculative bubbles as “a psychological

epidemic” in which people put reason aside and instead buy into a story.

“It’s a complicated social phenomenon that gets people into trouble, just

like smoking too much and drinking too much,” Mr. Shiller said.

And no matter how hard people try to avoid them, bubbles happen again and

again, from the Dutch tulip bubble of 1636, to the 1929 stock bubble that

resulted in the Great Depression, to the housing bubble that buckled Wall

Street in 2008.

Even the smartest get caught up. Isaac Newton, whose laws of motion and

gravity arguably make him the most important scientist ever, bought into

the South Sea Bubble of 1720. It was a bad bet on a company granted a

monopoly on trade with South America by the British government. He

reportedly said: “I can calculate the motions of the heavenly bodies, but

not the madness of people.”

Bubbles seem obvious after the crash, of course. The problem is they are

almost impossible to see in the present. Mr. Neumann admits he was caught

in the dot-com bubble.

“I was a true believer in the Internet and all that,” he said.

So, do the staggering values of today’s private tech companies look like

yet another bubble?

“If the question is, Are these valuations divorced from fundamentals? I

think they are,” he said.

I've been spending more time than I would like experiencing Uber.Uber has

a profound problem: They literally hate the fact that they have...

But that is not a bubble, he said. Rather, it is “an irrational pricing

decision.”

Investors are happy to admit that this torrid pace of investment has

started to worry them. But they still try to steer clear of the b-word,

unless they are describing what Silicon Valley is not.

“There’s definitely some craziness and people overpaying” for stakes in

companies, said Anand Sanwal, founder of CB Insights, an analytics firm

focused on the venture capital industry. “But a bunch of bad decisions

don’t necessarily mean we are in a bubble.”

Does George Zachary, a partner in the Menlo Park office of CRV, a venture

capital firm, think we’re in a bubble? “I think we’re in a period of

overvaluation and frothiness,” he said.

Sam Altman, president of Y Combinator, an incubator that invests in very

young companies, has grown so tired of bubble talk that this month he

countered it with a $100,000 “no bubble” bet.

The bet, which will be donated to charity, is based on several variables,

including his prediction that the five most valuable unicorns, a list that

includes Uber and Airbnb, the home rental service, will be worth more than

$200 billion by 2020.

Of course, there is a difference between not thinking there is a bubble

and not being concerned about how easy it has become for start-ups to

raise money.

“Do I think companies are overvalued as a whole? No,” Mr. Altman said. “Do

I think too much money can kill good companies? Yes. And that is an

important difference.”

Some investors go so far to avoid the word bubble that they describe

situations that sound quite a bit worse.

Take Charlie O’Donnell, founder of Brooklyn Bridge Ventures. His view is

that when it becomes harder to raise money, companies that are funding

losses with outside money will be forced to find profitability by cutting

jobs and slowing expansion plans, Mr. O’Donnell said.

But that is not a bubble, he said. Rather, as he outlined in a recent blog

post, that would be “the coming zombie start-up apocalypse.” |

|

****** Venture Capital

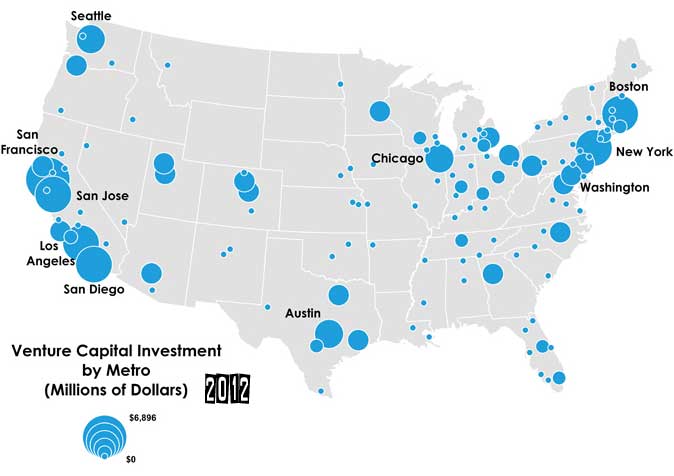

First and foremost, venture capital is more distributed

than it was in the late 1980s when Kenney and I conducted our original

studies. While Silicon Valley remains a leading center for venture

investment, it appears less dominant than it once was. Within the Bay Area

itself, the San Francisco area has in fact overtaken it as the nation’s

leading center for venture capital. In addition, a number of other metros

across the United States, including New York City, Washington, D.C.,

Philadelphia, and Boston in the Northeast are significant centers for

venture capital investment, as are Los Angeles and San Diego in Southern

California, and Seattle, Austin, and Chicago.

The table below provides more detail on the top 20 metros for venture

capital investment, showing how they stack up on total deals, companies,

and the dollar value of investment.

Top 20 Locations for Venture Capital Investment

Investments Deals

Rank Metropolitan Area

(listed by core city) Dollars

(Millions) Share of Total Number Share of Total

1 San Francisco-Oakland, CA $6,896 25.6% 744 19.7%

2 San Jose-Sunnyvale, CA $3,985 14.8% 415 11.0%

3 Boston, MA $3,101 11.5% 408 10.8%

4 New York, NY $2,269 8.4% 379 10.0%

5 Los Angeles, CA $1,677 6.2% 232 6.1%

6 San Diego, CA $1,134 4.2% 103 2.7%

7 Seattle, WA $886 3.3% 112 3.0%

8 Austin, TX $626 2.3% 87 2.3%

9 Chicago, IL $547 2.0% 71 1.9%

10 Washington, DC $484 1.8% 117 3.1%

11 Philadelphia, PA $347 1.3% 105 2.8%

12 Denver, CO $264 1.0% 53 1.4%

13 Atlanta, GA $262 1.0% 53 1.4%

14 Boulder, CO $256 1.0% 40 1.1%

15 Minneapolis-St. Paul, MN $256 0.9% 29 0.8%

16 Santa Barbara, CA $251 0.9% 14 0.4%

17 Phoenix, AZ $214 0.8% 15 0.4%

18 Raleigh-Cary, NC $184 0.7% 28 0.7%

19 Pittsburgh, PA $167 0.6% 76 2.0%

20 Provo-Orem, UT $162 0.6% 14 0.4%

Greater San Francisco, including Oakland, tops the list with nearly $7

billion dollars in venture capital investment in 2012, or one in four of

all of venture investments, compared to $4 billion or 15 percent, for San

Jose, the Silicon Valley. Together, these two Bay Area centers account for

more than $10 billion in venture investment, roughly 40 percent of all

dollars invested, along with 30 percent of all venture capital deals.

The Bos-Wash corridor is another major center for venture investment.

Greater Boston is next with just over $3 billion in venture capital

investment (11.5 percent) followed by New York with $2.3 billion (8.4

percent). Washington, D.C. is 10th with nearly $500 million, and

Philadelphia 11th with roughly $350 million (1.3 percent). Together, the

metros that make up the Bos-Wash corridor account for $6.2 billion in

venture capital investment—23 percent of the total.

Southern California is also a significant attractor of venture capital

investment. L.A. ranks fifth overall with $1.7 billion in venture

investment (6.2 percent of the total), San Diego sixth with $1.1 billion

(4.2 percent), and Santa Barbara 16th with roughly $250 million (slightly

less than one percent). Together the Southern California area accounts for

$3 billion in venture investment, about 11 percent of the total.

Other leading venture capital centers include: Seattle ($886 million),

Austin ($626 million), Chicago ($547 million), Denver ($264 million) and

nearby Boulder ($256 million), Atlanta ($262 million), Minneapolis-St.

Paul ($256 million), Phoenix ($214 million), Raleigh-Cary ($184 million),

Pittsburgh ($167 million), and Provo-Orem ($162 million).

Eight additional metros account for more than $100 million in venture

capital investment: Salt Lake City, Cleveland, Houston, Detroit,

Baltimore, Dallas, Portland, and Santa Rosa.

Overall, the Bay Area remains the leading center of venture capital

investment by far. But San Francisco now attracts more venture investment

than the Silicon Valley proper. Boston ranks third, but New York is close

behind. This supports the contention of a more general urban shift venture

capital back toward urban centers.

Future posts will look even more closely at this shift. Next up, I will

chart the determinants of venture capital investment across metros. I’ll

then turn to the micro-geography of venture capital investment within U.S.

metros using even more fine-grained data made available to us by the

National Venture Capital Association and Dow Jones. These data cover

telephone area codes and zip codes. Using these data, I’ll look in even

greater detail at the pattern of urban versus suburban venture capital

across America’s metro regions.

Richard Florida is Co-Founder and Editor at Large at The Atlantic Cities.

http://qz.com/481563/these-long-lost-vacation-photos-capture-the-tragicomedy-of-the-1990s-cruise-craze/ |

|

Silicon Valley and

Teenage Suicide: Talking With The Atlantic’s Hanna Rosin (Q&A)

November 22, 2015, 12:01 PM PST

By Noah Kulwin

Five years ago, a number of high school students in Palo Alto killed

themselves, a phenomenon that is referred to as a “suicide cluster.” Last

year, another tragic wave of suicides struck the Northern California city,

terrifying the affluent, otherwise picturesque community; two clusters so

close together was unheard of.

In her cover story for the December issue of The Atlantic, journalist

Hanna Rosin traveled to Palo Alto, home of Stanford University and the de

facto capital of tech, to report on the shocking problem of teenage

suicide in Silicon Valley. She discusses the psychological research behind

suicide, and the role of destructive social norms that push American

teenagers hard to be superhuman in all that they do.

For most people in Silicon Valley, success isn’t really a plateau that

you reach, but rather something that is constantly a few rungs above you,

perpetually out of reach. This is true across America, but especially so

in the Valley.

In an interview with Re/code, Rosin talked about the story and the ways

in which tech industry norms are interwoven into the Valley’s fabric of

life.

With entrepreneurs, it’s an endless cycle of raising money, hiring,

product tinkering, raising more money, hoping, praying, raising even more

money, rinse, repeat. For employees of bigger companies like Facebook or

Apple, it means stretching your workday to make sure that features and new

products ship on time. Or at least with as few screw-ups as possible.

Predictably, this industry culture isn’t totally confined to the

industry. In an interview with Re/code, Rosin talked about the story and

the ways in which tech industry norms are interwoven into the Valley’s

fabric of life. This interview has been edited and condensed for clarity.

Re/code: How did you come to this story?

Hanna Rosin: I came to it in kind of a backwards way. I was interested

in the research by this woman, Suniya Luthar, who I quote in the story

about the U-shaped curve between poor kids and really elite kids.

I just kept reading about the research; it’s this unusual body of data.

I talked to her on the phone, and she was talking to me about Palo Alto.

And she thought she was gonna head to Palo Alto, and then I looked up the

Palo Alto story, and then I realized — they’re in the middle of another

suicide cluster. So initially I thought that Palo Alto was just going to

be one example of many, but then I realized they were smack in the middle

of a second cluster, so all of these issues would be really alive to them

at that moment.

People were in serious, deep agony at meeting after meeting in the the

high schools and the community, and you could hear the anguish kind of

unfolding. “The Overprotected Kid” was another story I wrote, and I kind

of think of this as “The Overprotected Kid, Part Two,” with teenagers,

later down the road.

How do you think of this suicide problem when compared to other public

health issues at high schools? Like, say, injuries from football?

I think that deaths are just one of those things that call your

attention to it — the deaths make you not be able to ignore the problem.

But the actual deep problem, and I don’t know if this is analogous to

sports injuries, is that we all — parents, administrators, parents — kind

of have gone along and not really been paying attention to it. The deaths

are really what just call your attention to the actual problem.

Have you seen “The Sopranos”?

Oh, yes.

One of the “Sopranos”-like themes that I picked up on in your story was

how the high-school-age characters effectively relived the larger dramas

of their parents. So many of the kids in Palo Alto have parents who work

in Silicon Valley — did you see a connection there?

Absolutely. The bar is unreasonably high. The bar for dedication to

professional life, the bar for how much money you need to make. It’s like

everyone there has absorbed as a normal line of success what’s a

completely unusual measure for success. I interviewed a lot of shrinks,

who told me their patients come in with terrible anxiety because they

haven’t made, say, $10 million by the time they’re 40.

And they absorb that like a normal path for success, and they transmit

that onto their kids, like, “that’s what counts for success.” And that’s

actually extremely difficult to achieve, I think there’s a line in the

story from Suniya who says, “If you’ve never been to the moon, you

wouldn’t know that that was an option.”

Whereas these guys, they do go to the moon, they go there all the time.

They are the center of the universe, they make a huge amount of money —

that’s the culture that’s considered normal. So that permeates the school,

so what they think of as success is really unusual.

What you’re describing also sounds like a consequence of economic

segregation; that by creating communities of the ultrawealthy in Palo

Alto, you’re separating them from all these other people in the Bay Area

who have totally different lived experiences, and so Palo Alto high

schoolers have a very skewed idea of what’s “normal.”

Oh yeah, totally. That’s absolutely true. This is all about social

norms, and social norms get created and absorbed by everybody, and nobody

understands any alternative — or you forget that there is any alternative.

This is all about social norms, and social norms get created and

absorbed by everybody, and nobody understands any alternative — or you

forget that there is any alternative.

And I think that Palo Alto is a really excellent example of that. I was

thinking, would it be different if Pally or Gunn [high schools in Palo

Alto] were located in New York? And it would be different — New York is

diffused and spread out, and you’d be passing lots and lots of kinds of

people. You’d be bumping up against different social norms all the time.

But Palo Alto is like an island, it’s isolated, it’s essentially a nice

quiet suburb. You’re not in contact with many different kinds of people

doing different kinds of things.

So the vast majority of people are doing this one thing, have accepted

this one norm, and haven’t come into contact with many other norms.

Outside of the context of the Google engineer [whose daughter committed

suicide] who joins the school board that was in your story, did you see

any other instances where the tech industry got involved? Like say, a

Facebook employee comes to a high school auditorium and says, “Listen, I

didn’t go to college until I was 26, and dropped acid and walked around

Nepal — you’re all going to be okay.”

Well that is what was so funny to me! People told me this is fairly

typical, but the first generation of success stories in Silicon Valley are

like affluent college-dropout types, and this is a question that I didn’t

deal with, but how did that mutate into a kind of standardized, uniform,

AP testing, “get-into-college” obsession?

The problem right now is that there is only one narrative, whereas I

think in decades past there have been counter-narratives, like in the

’60s.

How do you mean?

It was like, “Screw the man! Drop out!” Even in the ’80s, there was a

counter-narrative to ’80s materialism; in the ’90s there was one, too. I

feel like there isn’t that counter-narrative, like we’ve lost it along the

way.

Even the kids who are protesting in colleges these days, the kids are

asking authorities to fix the problem, and that’s unusual. It used to be,

“Screw the authorities!” The weirdest part of the story to me was the loss

of agency, and how the kids have totally absorbed the norms.

That’s an eerily apt metaphor for how people perceive Silicon Valley.

Take the public character arc of Mark Zuckerberg: Harvard bad boy who

fucks with authority, creates his own app, becomes CEO of a fast-growing

brash company, and then he drops the hoodie, wears a tie, hires a former

Treasury official as his COO, and now his share price is way up. Are there

people in the community who are making these kinds of connections between

the industry and what’s happening?

Well, we’re in second-generation Silicon Valley now. A lot of people

say that it was initially “rebels” or “outsiders” and “visionaries” and

“kooks,” and now it’s much more, kind of, mainstream corporate. If any of

these kids came home to their parents and said, “I have this vision for

changing the world!” and want to drop out, their parents would be

horrified. That’s not part of the idiom, that’s not hugely admired.

You really found that was the case? There’s an entire subset of the

culture, especially around Stanford, that is telling people, “Hey drop

out, work on that startup, move fast, break shit.”

Maybe that becomes true after high school. Like maybe when you get a

bit of wiggle room, that becomes true. There are definitely kids who

thrive in Palo Alto’s culture, who are awesomely smart machines inventing

apps, and are insanely independent. You know, the culture attracts people

who love it and thrive in it, and aren’t destroyed by it in any way — they

totally flourish in the culture. That’s a type that I met. |

|